Understanding the complexities of tax forms can be overwhelming, especially when you encounter unfamiliar terms like "1099 G BO 2." This form is issued by state governments to individuals who have received unemployment benefits or other government payments during the tax year. It provides essential information for filing your federal and state tax returns accurately. If you've received a 1099 G BO 2, it's crucial to comprehend its purpose and implications. Whether you're self-employed, unemployed, or navigating a complex tax situation, this document plays a significant role in ensuring compliance with tax regulations.

The 1099 G BO 2 is not just another piece of paper; it's a critical component of your financial records. This form reports the total amount of unemployment compensation or other government payments you've received. It also includes details about any federal income tax withheld, which can significantly impact your tax liability or refund. As tax laws evolve, staying informed about these forms is essential to avoid penalties or audits. In this article, we will delve into the intricacies of 1099 G BO 2, offering clarity and actionable insights to help you navigate this often-confusing process.

While many people focus on W-2s or 1099-NECs, the 1099 G BO 2 deserves equal attention, particularly for those who have interacted with government assistance programs. Whether you're a freelancer, small business owner, or someone who has received unemployment benefits, understanding this form is key to maintaining financial health. By exploring its components, implications, and how it fits into your overall tax strategy, you'll gain the knowledge needed to make informed decisions. Let's dive deeper into the world of 1099 G BO 2 and uncover what it means for your tax obligations.

Read also:How Old Is Patti Labelle A Comprehensive Guide To The Legendary Singers Life And Career

What Exactly Is the 1099 G BO 2 Form?

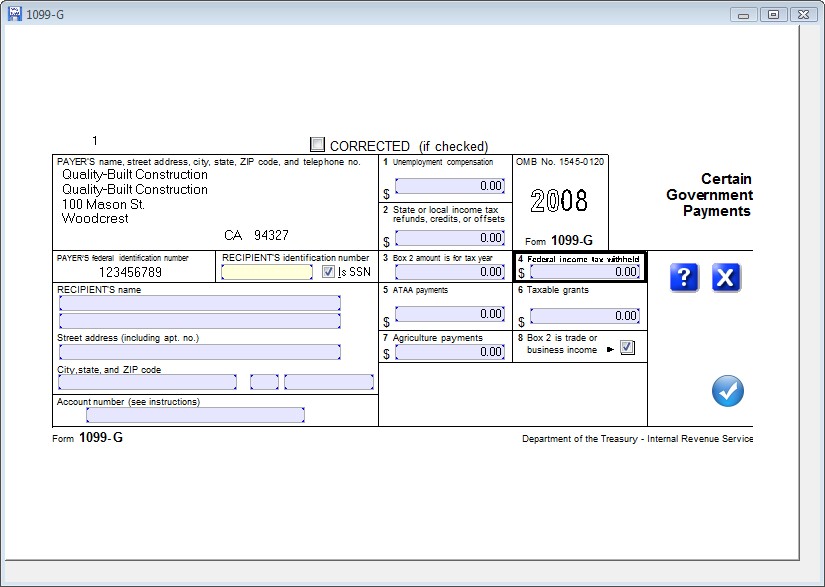

The 1099 G BO 2 form is an official document issued by state governments to report unemployment compensation and other government payments received during the tax year. Unlike other 1099 forms, which focus on income from investments or independent contracts, the 1099 G BO 2 specifically addresses government-related transactions. This form ensures transparency between taxpayers and the IRS, providing a detailed breakdown of payments and any taxes withheld. It's important to note that not all recipients of unemployment benefits will receive this form, as it only applies to those who have received significant payments or had taxes withheld.

Key components of the 1099 G BO 2 include:

- Total unemployment compensation received

- Amount of federal income tax withheld

- State-specific identifiers and codes

- Additional government payments, if applicable

Understanding these components is vital for accurate tax reporting. Many taxpayers overlook the importance of the 1099 G BO 2, assuming it's only relevant for unemployment benefits. However, it also encompasses other government payments, such as disaster relief or certain grants. This broad scope makes it a critical document for anyone interacting with government assistance programs.

Why Should You Care About 1099 G BO 2?

The 1099 G BO 2 isn't just a form to file away; it directly affects your tax liability and potential refund. If you've received unemployment benefits or other government payments, failing to account for them can lead to underpayment penalties or unexpected tax bills. For example, if federal income tax was withheld from your unemployment compensation, you may be eligible for a larger refund. Conversely, neglecting to report these payments could result in underreporting income, triggering IRS scrutiny.

Moreover, the 1099 G BO 2 helps ensure compliance with both federal and state tax laws. Each state may have unique requirements or additional reporting obligations tied to this form. Staying informed about these nuances is crucial for avoiding legal complications. By understanding the implications of the 1099 G BO 2, you empower yourself to make smarter financial decisions and maintain peace of mind during tax season.

How Does the 1099 G BO 2 Impact Your Tax Return?

One of the most common questions taxpayers have is, "How does the 1099 G BO 2 affect my tax return?" The answer lies in its role as a reporting mechanism for government payments. If you've received unemployment benefits or other assistance, these amounts must be included in your taxable income. However, certain exclusions or deductions may apply, depending on your circumstances. For instance, if you repaid unemployment benefits during the year, you might be able to deduct that amount from your taxable income.

Read also:Break Up Of Catriona Gray And Sam Milby What Really Happened

Another critical aspect of the 1099 G BO 2 is its impact on federal income tax withholding. If taxes were withheld from your unemployment compensation, this amount will reduce your overall tax liability. Conversely, if no taxes were withheld, you may owe additional payments when filing your return. Understanding these dynamics is essential for accurate tax planning and avoiding surprises during tax season.

Who Receives the 1099 G BO 2 Form?

Not everyone will receive a 1099 G BO 2 form. It is primarily issued to individuals who have received unemployment compensation or other government payments exceeding a certain threshold. This includes:

- Unemployed workers who collected state unemployment benefits

- Recipients of disaster relief payments

- Individuals who received certain grants or subsidies from government programs

It's worth noting that the 1099 G BO 2 is not limited to unemployment benefits. For example, if you received a state tax refund that exceeded a specific amount, it might also be reported on this form. The key factor is whether the payment qualifies as taxable income under federal or state guidelines. Understanding who qualifies for this form helps clarify its relevance to your financial situation.

Do You Need to File a 1099 G BO 2?

A common question among taxpayers is, "Do I need to file a 1099 G BO 2?" The answer depends on your circumstances. If you've received this form, it serves as a reporting tool rather than a standalone filing requirement. You must include the information from the 1099 G BO 2 in your federal and state tax returns, but you don't file the form itself with the IRS. Instead, it acts as a reference document to ensure accurate reporting of your income and taxes withheld.

For example, if you received unemployment benefits totaling $5,000 and had $500 in federal income tax withheld, you would report these amounts on your tax return. The 1099 G BO 2 provides the necessary details to complete this process correctly. By incorporating this information into your return, you fulfill your tax obligations while maximizing potential refunds or minimizing liabilities.

What Happens If You Don't Report the 1099 G BO 2?

Failing to report the information from your 1099 G BO 2 can lead to serious consequences. The IRS cross-references these forms with tax returns, so any discrepancies will likely trigger further investigation. If you neglect to include unemployment compensation or other government payments, you risk underreporting your income, which could result in penalties, interest charges, or even an audit. Similarly, failing to account for taxes withheld might cause you to miss out on potential refunds.

It's essential to address any discrepancies promptly if you believe there may be errors on your 1099 G BO 2. For instance, if the reported unemployment benefits exceed what you actually received, you should contact the issuing agency to resolve the issue. Proactive communication and timely corrections can prevent unnecessary complications down the line.

What Are Common Misconceptions About 1099 G BO 2?

Many misconceptions surround the 1099 G BO 2, leading to confusion and potential errors during tax preparation. One prevalent myth is that unemployment benefits are not taxable. While there are some exclusions, most unemployment compensation is considered taxable income and must be reported. Another misconception is that you only need to worry about the 1099 G BO 2 if you've received unemployment benefits. In reality, it covers a range of government payments, including disaster relief and certain grants.

Additionally, some taxpayers assume that receiving a 1099 G BO 2 automatically means they owe additional taxes. While this can be true in some cases, it depends on whether taxes were withheld and how the payments fit into your overall tax picture. Understanding these nuances helps dispel common myths and ensures accurate tax reporting.

How Can You Prepare for the 1099 G BO 2?

Proper preparation is key to handling the 1099 G BO 2 effectively. Start by gathering all relevant documents, including previous tax returns and records of government payments received. This will help you verify the accuracy of the information reported on the form. Additionally, consider consulting with a tax professional, especially if your situation involves complex interactions with government assistance programs.

If you anticipate receiving a 1099 G BO 2, it's wise to plan for potential tax implications. For example, if no taxes were withheld from your unemployment benefits, you may want to set aside funds to cover any additional liability. By taking proactive steps, you can minimize surprises and ensure smooth filing during tax season.

What Should You Do If You Disagree With Your 1099 G BO 2?

Discrepancies on your 1099 G BO 2 can arise for various reasons, such as incorrect reporting of unemployment benefits or taxes withheld. If you notice errors, it's important to address them promptly. Contact the issuing agency to request corrections and document all communication. In some cases, you may need to file an amended return to reflect the accurate information.

For example, if the form reports higher unemployment benefits than you actually received, failing to correct this could lead to overpayment of taxes or underreporting income. By resolving these issues early, you protect yourself from potential penalties and ensure compliance with tax regulations.

How Can You Maximize Your Tax Benefits With the 1099 G BO 2?

While the 1099 G BO 2 primarily reports taxable income, it also offers opportunities to maximize tax benefits. For instance, if you repaid unemployment benefits during the year, you might qualify for a deduction. Additionally, certain exclusions or credits could reduce your overall tax liability. Exploring these possibilities with a tax professional can help you optimize your return while staying compliant.

Another strategy is to review your withholding arrangements for future payments. If you anticipate receiving unemployment benefits or other government payments, you can choose to have federal income tax withheld at a rate that aligns with your expected tax liability. This proactive approach can simplify tax planning and avoid surprises during filing season.

What Are the Deadlines for 1099 G BO 2 Reporting?

Understanding deadlines is crucial for handling the 1099 G BO 2 correctly. Taxpayers typically receive this form by January 31st following the tax year. However, if you don't receive it by mid-February, you should contact the issuing agency to request a copy. Remember, even if you haven't received the form, you're still responsible for reporting the information accurately on your tax return by the April deadline.

For businesses or government agencies issuing the 1099 G BO 2, the deadline to submit copies to the IRS is typically February 28th (or March 31st if filing electronically). Staying aware of these timelines helps ensure timely compliance and avoids unnecessary delays or penalties.

Can You File Without the 1099 G BO 2?

Yes, you can file your tax return without the 1099 G BO 2 if necessary. However, you must still report the income and taxes withheld based on your records. If you're missing this form, gather any available documentation to estimate the amounts accurately. Once you receive the official 1099 G BO 2, compare it to your filed return and make any necessary adjustments. In some cases, this may require filing an amended return to correct discrepancies.

Conclusion

The 1099 G BO 2 is a vital component of tax reporting for those who have received unemployment benefits or other government payments. By understanding its purpose, components, and implications, you can ensure accurate tax filings and maximize potential benefits. Whether you're navigating unemployment compensation, disaster relief, or other government assistance programs, staying informed about the 1099 G BO 2 empowers you to make smarter financial decisions and maintain compliance with tax regulations.

Table of Contents

- What Exactly Is the 1099 G BO 2 Form?

- Why Should You Care About 1099 G BO 2?

- How Does the 1099 G BO 2 Impact Your Tax Return?

- Who Receives the 1099 G BO 2 Form?

- Do You Need to File a 1099 G BO 2?

- What Happens If You Don't Report the 1099 G BO 2?