The 1099-G form is an essential document for taxpayers who received government payments during the year, including unemployment compensation, state tax refunds, or other government-related payments. This form is issued by state and local governments to individuals who received payments or credits that may need to be reported on their federal income tax return. If you’ve received a 1099-G, it’s important to understand what it represents and how it affects your tax filing. As tax season approaches, many individuals are left wondering about the specifics of this form and its implications for their tax obligations.

For those unfamiliar with the concept, the 1099-G serves as a record of government payments that could impact your taxable income. It’s crucial to review the information provided on this form carefully, as errors or misunderstandings could lead to complications during tax filing. Whether you’re self-employed, unemployed, or simply received a state tax refund, understanding the 1099-G can help ensure a smoother tax season and reduce the risk of audits or penalties.

As we delve deeper into the topic, we’ll explore the nuances of the 1099-G, its purpose, and how it fits into the broader framework of U.S. tax regulations. This article aims to provide clarity and actionable insights for taxpayers who want to stay compliant and informed. By the end, you’ll have a clear understanding of what the 1099-G is, why it matters, and how to handle it during tax season.

Read also:Exploring The Mysterious Connection Between Thanos And Squid Games Drug Use

What is a 1099-G?

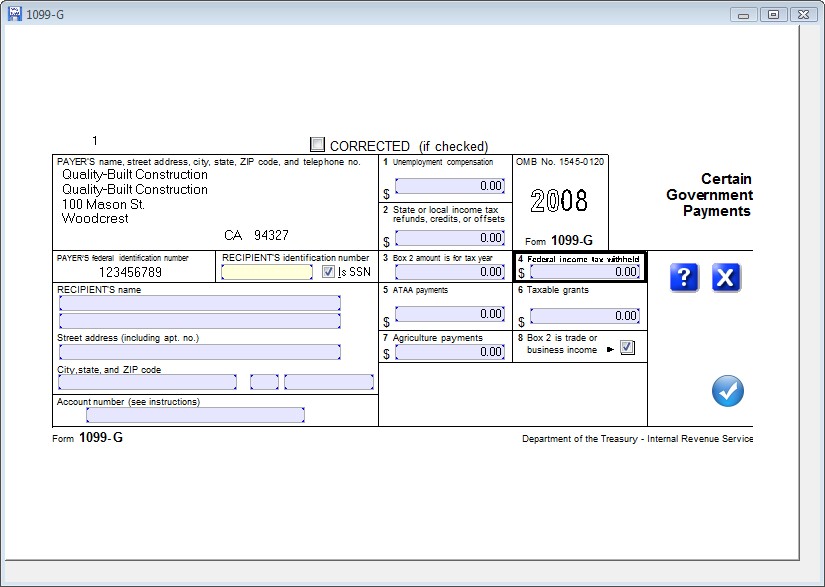

The 1099-G form is issued annually by state and local governments to report payments made to individuals during the previous year. These payments can include unemployment benefits, state tax refunds, agricultural payments, and other government-related disbursements. Understanding what is a 1099-G is critical because it directly impacts your federal tax return, and failure to report the information correctly could result in underpayment or overpayment of taxes.

One common misconception is that all amounts listed on the 1099-G are taxable. However, this isn’t always the case. For example, state tax refunds are only taxable if they exceed the amount of itemized deductions you claimed in the previous year. Similarly, certain unemployment benefits may be excluded from taxable income depending on federal law changes. Therefore, it’s important to consult IRS guidelines or a tax professional when interpreting your 1099-G.

Why Do You Receive a 1099-G?

If you’ve received a 1099-G, it means you were paid by a government entity, and the amount needs to be reported for federal tax purposes. Common reasons for receiving this form include:

- Unemployment compensation

- State or local tax refunds

- Agricultural payments

- Other government assistance programs

Each of these categories is reported separately on the form, making it easier for taxpayers to identify which payments are taxable and which are not. For instance, unemployment benefits have historically been taxable, but recent legislative changes have exempted certain amounts. Understanding these nuances is key to accurate tax reporting.

When Do You Need to File the 1099-G?

While the 1099-G itself doesn’t need to be filed with the IRS, the information it contains must be included on your federal tax return. Typically, you’ll report the amounts listed on the 1099-G on Schedule 1 of Form 1040. It’s important to note that deadlines for receiving the 1099-G vary by state, but most forms are issued by January 31st of the following year. If you haven’t received your 1099-G by mid-February, contact the issuing agency to request a copy.

How Does the 1099-G Affect Your Taxes?

One of the most common questions taxpayers ask is, “What is a 1099-G and how does it affect my taxes?” The short answer is that the 1099-G provides critical information about government payments you received during the year, which may increase or decrease your taxable income. For example, if you received a significant state tax refund, it could be considered taxable income if you itemized deductions in the previous year. On the other hand, some unemployment benefits may be excluded from taxable income under certain circumstances.

Read also:Chuku Modu A Rising Star In Nollywood And Beyond

Can You Ignore the 1099-G?

Ignoring the 1099-G is not advisable, as it contains important information that could affect your tax liability. Even if you believe the amounts listed on the form are incorrect, failing to address them could lead to penalties or interest charges. Instead, verify the information with the issuing agency and consult a tax professional if necessary. Remember, the IRS matches 1099-G forms with tax returns, so discrepancies could trigger an audit or correspondence from the IRS.

What Should You Do If You Disagree with the 1099-G?

If you believe the information on your 1099-G is incorrect, don’t panic. Start by contacting the issuing agency to request a corrected form. Be prepared to provide documentation supporting your claim, such as proof of reduced unemployment benefits or a smaller state tax refund. If the issue isn’t resolved, you can still file your taxes using the original 1099-G and explain the discrepancy on your tax return or in an attachment.

Who Issues the 1099-G?

The 1099-G is issued by state and local governments, as well as federal agencies, depending on the type of payment. For example, unemployment benefits are typically reported by state unemployment offices, while agricultural payments may come from federal agencies. Understanding who issued your 1099-G can help you determine the appropriate contact for resolving any issues or requesting additional information.

Where Can You Find Your 1099-G?

Most states offer online access to 1099-G forms through their respective tax portals. If you prefer a paper copy, you can request one from the issuing agency. Keep in mind that the deadline for receiving the 1099-G is January 31st, but some states may extend this deadline under special circumstances. Always check with your state’s tax authority for specific details.

How to Report the 1099-G on Your Tax Return?

Reporting the 1099-G on your tax return involves transferring the relevant amounts to the appropriate lines on Form 1040, Schedule 1. For instance, unemployment compensation is reported on Line 7, while state tax refunds are reported on Line 8a. Be sure to review IRS instructions carefully to ensure accurate reporting. If you’re unsure about how to handle specific entries, consider using tax preparation software or consulting a tax professional.

What Happens If You Don’t Report the 1099-G?

Failing to report the 1099-G could result in penalties, interest charges, or even an audit. The IRS matches 1099-G forms with tax returns, so any discrepancies will be flagged for further review. If you receive correspondence from the IRS regarding your 1099-G, respond promptly to avoid additional complications. In some cases, you may need to amend your tax return to include the missing information.

What Is a 1099-G and Why Is It Important?

To summarize, the 1099-G is a critical document that reports government payments you received during the year, including unemployment benefits, state tax refunds, and other disbursements. Understanding what is a 1099-G and its implications is essential for accurate tax reporting and compliance. By staying informed and addressing any issues proactively, you can avoid unnecessary stress and ensure a smoother tax season.

Table of Contents

- What is a 1099-G?

- Why Do You Receive a 1099-G?

- When Do You Need to File the 1099-G?

- How Does the 1099-G Affect Your Taxes?

- Can You Ignore the 1099-G?

- What Should You Do If You Disagree with the 1099-G?

- Who Issues the 1099-G?

- Where Can You Find Your 1099-G?

- How to Report the 1099-G on Your Tax Return?

- What Happens If You Don’t Report the 1099-G?

In conclusion, the 1099-G is a vital component of tax reporting for millions of Americans each year. By understanding its purpose, requirements, and implications, you can take control of your tax situation and ensure compliance with federal regulations. Whether you’re dealing with unemployment benefits, state tax refunds, or other government payments, the 1099-G plays a central role in your tax obligations. Stay informed, ask questions, and seek professional guidance when needed to make the most of this important document.