What is 1099-G and why does it matter to you? Each year, millions of taxpayers receive a 1099-G form in the mail, detailing payments received from government entities. This document is critical for accurately filing your taxes, as it reports income such as unemployment compensation, state tax refunds, and other government-related payments. Ignoring this form could lead to errors in your tax return, potentially resulting in penalties or audits. Understanding the purpose and details of the 1099-G form is essential for ensuring compliance with IRS regulations and optimizing your tax situation.

For many individuals, the 1099-G form may seem confusing or overwhelming. However, its role in the tax process is straightforward. This document serves as a record of any payments you received from government agencies during the previous year. Whether you received unemployment benefits, a state tax refund, or other forms of government compensation, the 1099-G form ensures that these payments are accounted for in your annual tax return. By accurately reporting this information, you can avoid unnecessary complications with the IRS.

The importance of understanding what is 1099-G cannot be overstated. Failing to report the correct information from this form can lead to significant financial consequences. This guide will break down everything you need to know about the 1099-G form, including who receives it, what information it contains, and how to use it effectively when preparing your taxes. Whether you're a first-time filer or a seasoned taxpayer, this article aims to provide clarity and confidence in navigating this essential tax document.

Read also:Top Hardware Store In Simi Valley Your Ultimate Guide To Quality Tools And Supplies

What is 1099-G and Who Should Expect to Receive It?

The 1099-G form is issued by government entities to individuals who have received certain types of payments during the tax year. If you received unemployment compensation, state tax refunds, or other government-related payments, you are likely to receive this form. The IRS requires that these payments be reported to ensure accurate tax filings. For example, if you collected unemployment benefits during the year, the total amount will be detailed on the 1099-G form, allowing you to include it in your taxable income.

How Does the 1099-G Form Impact Your Tax Return?

Once you receive your 1099-G form, it's crucial to incorporate the information into your tax return. This form reports payments such as unemployment compensation, which may be subject to federal taxation. Additionally, if you received a state tax refund, you may need to include part or all of it in your taxable income, depending on your specific circumstances. By carefully reviewing the details provided on the 1099-G form, you can ensure that your tax return accurately reflects all sources of income, thereby minimizing the risk of errors or audits.

What Should You Do If You Don't Receive Your 1099-G Form?

Occasionally, taxpayers may not receive their 1099-G form by the IRS deadline. If this happens, it's important to take action promptly. Contact the issuing agency to request a copy of the form, and keep a record of your communication. In the meantime, you can still file your taxes using the best available information. However, once you receive the 1099-G form, you should amend your tax return if necessary to ensure all income is properly reported. This proactive approach demonstrates your commitment to compliance and transparency with the IRS.

What is Included in the 1099-G Form?

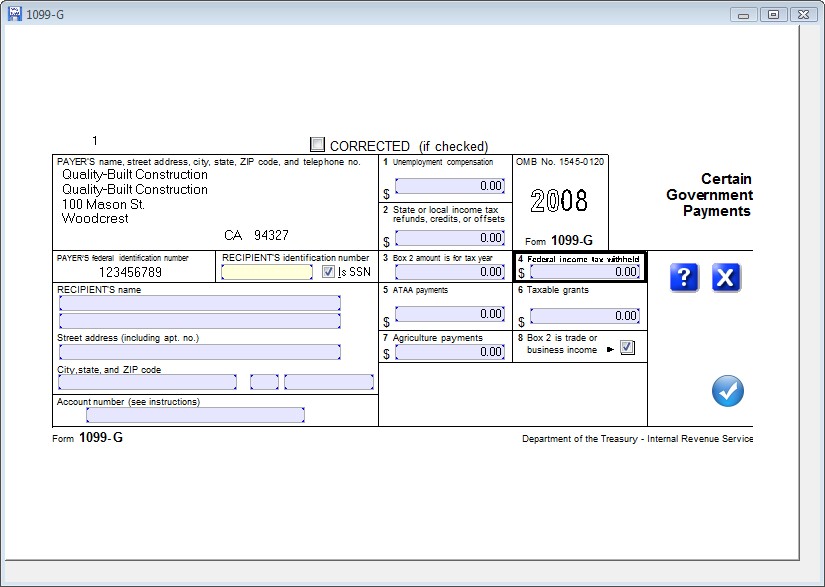

The 1099-G form provides detailed information about payments you received from government entities. Key sections include Box 1, which reports unemployment compensation, and Box 3, which details state tax refunds. Each box corresponds to a specific type of payment, and it's essential to review all sections carefully. For instance, if you received unemployment benefits, Box 1 will show the total amount, which you must include in your taxable income. Similarly, Box 3 will indicate the amount of any state tax refund you received, which may also be taxable depending on your situation.

Why is Accurate Reporting of 1099-G Information Critical?

Reporting the information from your 1099-G form accurately is vital for avoiding penalties or audits. The IRS cross-references the data provided on the form with your tax return, so any discrepancies could raise red flags. For example, if you fail to report unemployment compensation or state tax refunds, the IRS may initiate an investigation. To prevent such issues, double-check the details on your 1099-G form and ensure they align with your tax return. This diligence helps protect you from unnecessary complications and ensures compliance with tax regulations.

What Happens If You Underreport or Overreport Information from the 1099-G Form?

Underreporting or overreporting information from the 1099-G form can lead to significant consequences. If you underreport income, such as unemployment compensation or state tax refunds, you may owe additional taxes, interest, and penalties. Conversely, overreporting could result in an incorrect refund or tax liability. Both scenarios can trigger IRS scrutiny, potentially leading to audits or legal action. To avoid these issues, carefully review your 1099-G form and consult with a tax professional if you're unsure about any details.

Read also:Discover The Magic Of Clifton Park Movies Your Ultimate Guide To Cinema Adventures

Common Misconceptions About the 1099-G Form

Many taxpayers misunderstand the purpose and implications of the 1099-G form. One common misconception is that all payments reported on this form are taxable. In reality, some payments, such as certain grants or rebates, may not be subject to federal taxation. Another misunderstanding is that the 1099-G form is only relevant for unemployment compensation. However, it also covers a wide range of government-related payments, including state tax refunds and agricultural payments. By clarifying these misconceptions, you can better understand how the 1099-G form affects your tax situation.

What is the Deadline for Receiving the 1099-G Form?

Government agencies are required to send out 1099-G forms by January 31st of each year. This deadline ensures that taxpayers have sufficient time to gather all necessary documents before filing their tax returns. If you haven't received your 1099-G form by early February, it's advisable to contact the issuing agency to request a copy. Keeping track of this deadline is crucial for staying organized and ensuring that you have all the information needed to file your taxes accurately and on time.

What Should You Do If You Disagree with the Information on Your 1099-G Form?

If you notice discrepancies or errors on your 1099-G form, it's important to address them promptly. Contact the issuing agency to clarify any issues and request corrections if necessary. For example, if the form incorrectly reports unemployment compensation or state tax refunds, resolving these inaccuracies is essential for avoiding potential tax liabilities. Document all communications with the agency and keep copies of any correspondence. If the issue remains unresolved, consult a tax professional for guidance on how to proceed.

Practical Tips for Managing Your 1099-G Form

To effectively manage your 1099-G form, consider the following tips:

- Organize all tax-related documents in one place for easy access.

- Review the information on your 1099-G form carefully before filing your taxes.

- Consult a tax professional if you're unsure about any details or implications.

- Keep copies of your 1099-G form and tax return for future reference.

How Can You Ensure Compliance with IRS Regulations?

Ensuring compliance with IRS regulations involves several key steps. First, verify that all information on your 1099-G form matches your records. Next, incorporate the reported payments into your tax return accurately. Finally, maintain thorough documentation of your tax filings and communications with government agencies. By following these best practices, you can demonstrate your commitment to compliance and minimize the risk of errors or audits.

Conclusion: Mastering the 1099-G Form for Tax Success

In summary, understanding what is 1099-G is essential for accurate tax filing and compliance with IRS regulations. This form provides critical information about government-related payments, including unemployment compensation and state tax refunds. By carefully reviewing and accurately reporting the details on your 1099-G form, you can ensure a smooth and successful tax filing process. Stay informed, organized, and proactive to navigate the complexities of the 1099-G form with confidence.

Table of Contents

- What is 1099-G and Who Should Expect to Receive It?

- How Does the 1099-G Form Impact Your Tax Return?

- What Should You Do If You Don't Receive Your 1099-G Form?

- What is Included in the 1099-G Form?

- Why is Accurate Reporting of 1099-G Information Critical?

- What Happens If You Underreport or Overreport Information from the 1099-G Form?

- Common Misconceptions About the 1099-G Form

- What is the Deadline for Receiving the 1099-G Form?

- What Should You Do If You Disagree with the Information on Your 1099-G Form?

- Practical Tips for Managing Your 1099-G Form