What is a 1099-G form, and why does it matter in Colorado? For many residents of Colorado, the tax season brings a mix of questions and obligations. One form that has gained attention in recent years is the 1099-G. This document reports certain types of income that may not be immediately obvious to taxpayers, such as unemployment compensation, state or local income tax refunds, or other government payments. If you received a 1099-G from Colorado, it’s essential to understand what it represents and how it affects your tax return. Failing to report this information could lead to penalties or an inaccurate tax filing.

For individuals who received unemployment benefits or any other government-related payments during the year, the 1099-G plays a critical role in ensuring compliance with federal and state tax laws. It provides a detailed breakdown of the amounts you received, which helps you accurately report your income. Moreover, understanding the nuances of the "what is a 1099g Colorado" form can save you from potential audits or discrepancies during the filing process. Whether you’re self-employed, a small business owner, or someone who received government assistance, this guide will clarify everything you need to know.

This article aims to break down the complexities surrounding the 1099-G form in Colorado. From its purpose to how it impacts your tax obligations, we’ll provide actionable insights and tips to ensure you’re fully prepared for tax season. By the end of this guide, you’ll have a clear understanding of what to expect and how to handle your 1099-G efficiently.

Read also:Yailin Williams The Rising Star Taking The Music World By Storm

What Is the Purpose of the 1099-G Form?

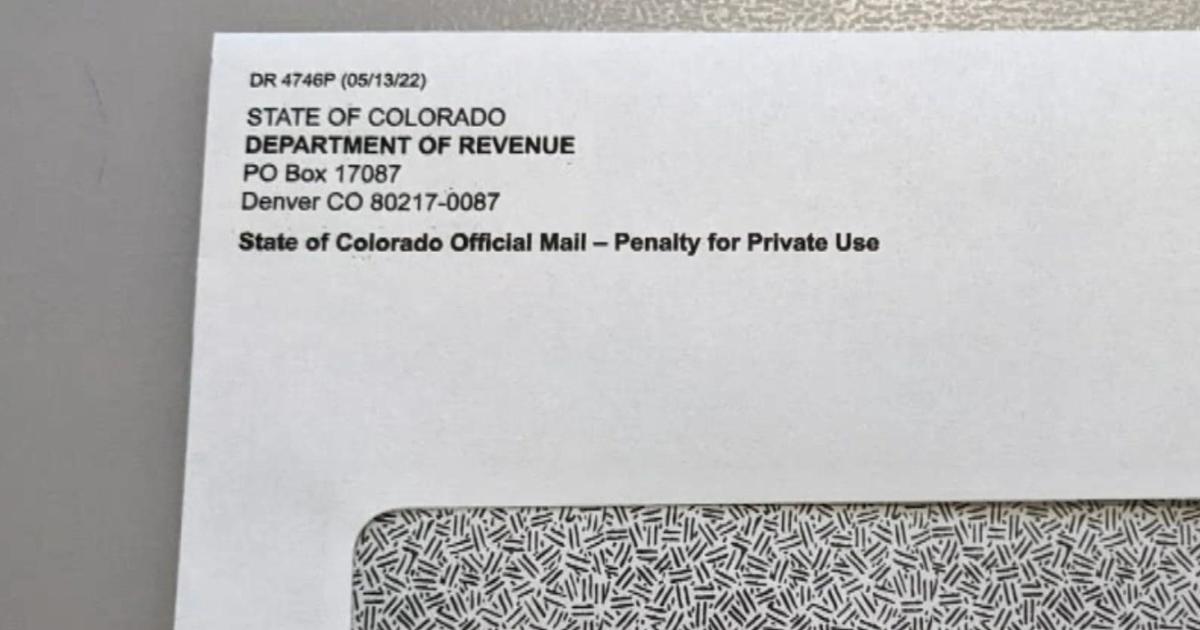

The 1099-G form is issued by government entities to report payments made to individuals during the tax year. These payments could include unemployment compensation, tax refunds, or other government-related disbursements. For Colorado residents, this form is crucial because it ensures all income sources are accounted for during tax filing. If you received unemployment benefits or a state tax refund, the 1099-G will outline these amounts, making it easier for you to report them accurately on your federal and state returns.

For example, if you were unemployed and received benefits through Colorado’s unemployment program, the 1099-G will specify the total amount paid to you. Similarly, if you received a refund from the Colorado Department of Revenue after filing your state taxes last year, this amount will also be reflected. Understanding the purpose of the "what is a 1099g Colorado" form can help you avoid underreporting or overreporting your income, which could lead to penalties or interest charges.

How Does the 1099-G Form Impact Colorado Taxpayers?

For Colorado residents, the 1099-G form directly impacts your tax obligations by reporting specific types of income that might not be immediately obvious. If you received unemployment benefits, for instance, these payments are considered taxable income at the federal level. Similarly, any refunds you received from the Colorado Department of Revenue must be reported on your federal tax return. This ensures that you’re not claiming a deduction for the same amount twice.

It’s important to note that the 1099-G form may also include other government payments, such as grants or disaster relief funds. Each of these payments is categorized under specific boxes on the form, making it easier for you to identify and report them correctly. If you’re unsure about how to handle your "what is a 1099g Colorado" form, consulting with a tax professional or using tax preparation software can provide additional guidance.

What Should You Do If You Receive a 1099-G in Colorado?

If you’ve received a 1099-G from the State of Colorado, the first step is to review the form carefully. Verify that the amounts listed match your records, and ensure that all payments are accurately reported. If you notice any discrepancies, contact the issuing agency immediately to resolve the issue. Additionally, keep a copy of the form for your records and include the information on your federal and state tax returns.

For those who received unemployment benefits, it’s crucial to understand the tax implications. While these payments are taxable at the federal level, Colorado does not tax unemployment income. This means you’ll only need to report the amounts on your federal return. However, if you received a state tax refund, that amount must be included in your federal taxable income. By staying informed about the "what is a 1099g Colorado" requirements, you can avoid common pitfalls during tax season.

Read also:Telugu Culture A Rich Tapestry Of Tradition And Modernity

When Should You Expect Your 1099-G Form?

Taxpayers in Colorado should expect to receive their 1099-G forms by the end of January each year. This timeline aligns with federal regulations requiring government agencies to issue these forms promptly. If you haven’t received your 1099-G by mid-February, it’s advisable to reach out to the issuing agency to confirm the status of your form. Delayed forms can disrupt your tax filing process, so staying proactive is key.

What Happens If You Don’t Receive Your 1099-G?

If you don’t receive your 1099-G form by the expected deadline, don’t panic. While the form provides valuable information, it’s not a strict requirement for filing your taxes. You can use your own records to estimate the amounts and report them on your tax return. However, it’s always best to contact the issuing agency to request a duplicate copy. In the meantime, keep detailed records of any government payments you received during the year to ensure accuracy.

Why Is It Important to Report 1099-G Income?

Reporting the income listed on your 1099-G is essential for maintaining compliance with both federal and state tax laws. Failure to report these amounts can result in penalties, interest charges, or even audits. For example, if you received unemployment benefits but neglected to report them, the IRS may flag your return for further review. Similarly, failing to include a state tax refund on your federal return could lead to discrepancies that require clarification.

Who Should File a 1099-G in Colorado?

Not everyone will receive a 1099-G form in Colorado. This document is typically issued to individuals who received unemployment benefits, state or local tax refunds, or other government payments during the year. If you fall into any of these categories, it’s important to pay attention to your 1099-G and include the information on your tax return. For those who didn’t receive such payments, there’s no need to worry about this form.

What Should You Do If You Disagree With the Amounts on Your 1099-G?

If you disagree with the amounts reported on your 1099-G, the first step is to double-check your own records. Compare the figures on the form with your bank statements, pay stubs, or other documentation to identify any discrepancies. If the amounts still don’t match, contact the issuing agency to request clarification or corrections. In some cases, errors can occur due to administrative mistakes, but resolving them promptly can prevent complications during tax season.

What Is a 1099-G Colorado and How Does It Affect Your Tax Return?

The "what is a 1099g Colorado" form is a critical document for anyone who received government-related payments during the year. Whether you collected unemployment benefits, received a state tax refund, or obtained other forms of assistance, this form ensures that all income is accurately reported. Ignoring or misreporting these amounts can lead to penalties, so it’s vital to handle your 1099-G with care. By understanding its purpose and impact, you can file your taxes with confidence and avoid potential issues.

How Can You Prepare for Filing With a 1099-G?

Preparing for tax season with a 1099-G involves gathering all relevant documents and understanding how they fit into your overall tax strategy. Start by collecting your W-2s, 1099s, and any other income-related forms. Next, review your 1099-G carefully to ensure accuracy. If you’re unsure about how to handle specific amounts, consult with a tax professional or use tax preparation software to simplify the process. Planning ahead can save you time and reduce stress during the filing period.

What Are Common Mistakes to Avoid With the 1099-G?

One of the most common mistakes taxpayers make with the 1099-G is failing to report all required amounts. Whether it’s unemployment benefits, state tax refunds, or other payments, each figure must be included on your tax return. Another error is misinterpreting the form, leading to incorrect reporting. To avoid these pitfalls, take the time to review the instructions carefully and seek clarification if needed. Additionally, keep detailed records throughout the year to streamline the filing process.

What Are the Tax Implications of the 1099-G in Colorado?

The tax implications of the 1099-G vary depending on the types of payments reported. For example, unemployment benefits are taxable at the federal level but exempt from Colorado state taxes. State tax refunds, on the other hand, must be included in your federal taxable income but may not affect your state return. Understanding these nuances is crucial for accurately calculating your tax liability. If you’re unsure about the specifics, consulting with a tax expert can provide clarity and peace of mind.

Conclusion: Mastering the 1099-G in Colorado

In summary, the "what is a 1099g Colorado" form plays a pivotal role in ensuring accurate tax reporting for residents who received government payments during the year. Whether you’re dealing with unemployment benefits, state tax refunds, or other disbursements, this document provides the information you need to file your taxes correctly. By staying informed and organized, you can navigate the complexities of the 1099-G with confidence and avoid potential pitfalls.

Table of Contents

- What Is the Purpose of the 1099-G Form?

- How Does the 1099-G Form Impact Colorado Taxpayers?

- What Should You Do If You Receive a 1099-G in Colorado?

- When Should You Expect Your 1099-G Form?

- What Happens If You Don’t Receive Your 1099-G?

- Why Is It Important to Report 1099-G Income?

- Who Should File a 1099-G in Colorado?

- What Should You Do If You Disagree With the Amounts on Your 1099-G?

- What Is a 1099-G Colorado and How Does It Affect Your Tax Return?

- How Can You Prepare for Filing With a 1099-G?