Are you puzzled by the complexities of the 1099-G BO 2 form and its implications for your tax filings? As tax season approaches, it's crucial to have a clear understanding of what this form entails and how it impacts your financial responsibilities. The 1099-G BO 2 is a document issued by state and local governments to report certain payments made to individuals, such as unemployment compensation, state tax refunds, and other government payments. Understanding its purpose and requirements is essential for ensuring accurate tax reporting and avoiding potential penalties.

This form can be intimidating for those unfamiliar with tax terminology and procedures. However, by breaking down its components and exploring its relevance in the broader tax landscape, we can demystify the 1099-G BO 2. This article aims to provide a comprehensive overview, covering everything from its purpose to how it should be handled during tax preparation. Whether you're a first-time filer or a seasoned taxpayer, gaining insight into the 1099-G BO 2 can significantly enhance your tax filing process.

As we delve deeper into this topic, you'll discover practical tips, expert advice, and actionable insights to help you navigate the complexities of the 1099-G BO 2. By the end of this guide, you'll be equipped with the knowledge to confidently address any questions or concerns you may have about this form and its role in your tax obligations. Let's explore how to make sense of the 1099-G BO 2 and ensure a smoother tax filing experience.

Read also:Undress Ai The Revolutionary Technology Redefining Privacy And Ethics

What Exactly is the 1099-G BO 2?

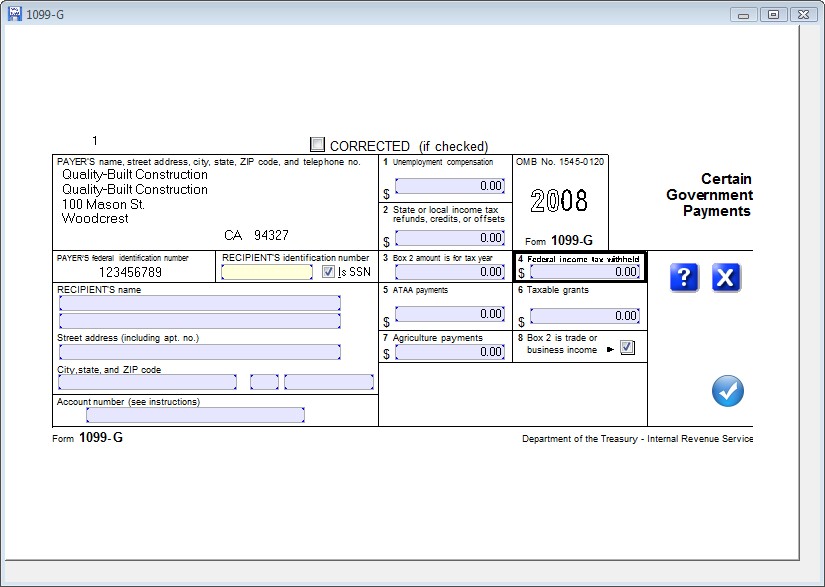

The 1099-G BO 2 form is a document issued by government entities to report payments made to individuals during the tax year. It includes various types of payments, such as unemployment compensation, state tax refunds, and other government-related disbursements. Understanding the specifics of this form is vital for accurate tax reporting, as it provides critical information that must be included in your federal tax return.

This form serves as a record of income received from government sources, ensuring that taxpayers account for all financial transactions accurately. The IRS requires recipients of such payments to report them, making the 1099-G BO 2 an essential component of the tax filing process. Familiarizing yourself with its structure and purpose can help streamline your tax preparation and avoid potential discrepancies.

Why Should You Care About the 1099-G BO 2?

Ignoring the 1099-G BO 2 could lead to significant consequences, including underreporting income and facing penalties from the IRS. This form ensures that all government payments received are accounted for in your tax filings. For instance, if you received unemployment benefits, a state tax refund, or any other government payment, the 1099-G BO 2 will provide the necessary details to include in your tax return.

By paying attention to the information provided in the 1099-G BO 2, you can avoid common tax filing errors and ensure compliance with IRS regulations. Understanding its relevance can save you from unnecessary stress and financial burdens during tax season. It's essential to treat this form with the importance it deserves in your overall tax strategy.

How Does the 1099-G BO 2 Impact Your Tax Return?

One of the most pressing questions taxpayers have is, "How does the 1099-G BO 2 affect my tax return?" The answer lies in its role as a reporting tool for government payments. These payments are considered taxable income, meaning they must be included in your total income when filing your taxes. For example, if you received unemployment compensation, the amount reported on the 1099-G BO 2 must be added to your taxable income, potentially affecting your tax liability.

Additionally, the 1099-G BO 2 can influence your eligibility for certain tax credits and deductions. By accurately reporting the information from this form, you can optimize your tax return and potentially reduce your tax burden. It's crucial to consult with a tax professional if you're unsure about how the 1099-G BO 2 impacts your specific tax situation.

Read also:Discover The Comfort Of Cal King Mattresses Your Ultimate Sleep Solution

What Types of Payments Are Reported on the 1099-G BO 2?

The 1099-G BO 2 encompasses a variety of payments made by government entities, including unemployment compensation, state tax refunds, and other forms of government assistance. Each type of payment has specific implications for your tax return, making it essential to understand the details reported on this form. For instance, unemployment benefits are taxable, and the amount must be reported as income on your federal tax return.

State tax refunds are another common payment reported on the 1099-G BO 2. If you received a refund from your state tax department, it may need to be included in your federal taxable income, depending on your circumstances. Other government payments, such as grants or subsidies, may also appear on this form, requiring careful consideration during tax preparation.

When Should You Expect to Receive the 1099-G BO 2?

Many taxpayers wonder, "When will I receive my 1099-G BO 2?" Typically, these forms are issued by January 31st following the tax year in question. Government entities are required to send out the 1099-G BO 2 to recipients by this deadline, giving taxpayers ample time to prepare their tax returns before the April filing deadline. However, it's important to check with the issuing agency if you haven't received your form by mid-February to avoid delays in your tax filing process.

Receiving the 1099-G BO 2 promptly allows you to address any discrepancies or questions you may have about the reported information. If you notice any errors or omissions, contacting the issuing agency promptly can help resolve issues before filing your taxes. Staying organized and proactive can prevent potential complications during tax season.

How Can You Verify the Accuracy of the 1099-G BO 2?

To ensure the information on your 1099-G BO 2 is accurate, it's crucial to review the details carefully. Double-check the reported amounts against your own records to confirm they match. If you notice any discrepancies, such as incorrect payment amounts or missing information, it's important to reach out to the issuing agency for clarification. Asking, "How can I verify the accuracy of my 1099-G BO 2?" is a vital step in maintaining tax compliance.

Verifying the accuracy of this form can prevent potential issues with the IRS and ensure your tax return reflects the correct financial information. Keeping detailed records of all government payments received throughout the year can make this process smoother and more efficient. If you're unsure about any aspect of the 1099-G BO 2, consulting a tax professional can provide valuable guidance and peace of mind.

What Steps Should You Take if You Lose Your 1099-G BO 2?

Losing your 1099-G BO 2 can be stressful, but there are steps you can take to retrieve the necessary information. First, contact the issuing agency to request a duplicate copy. Many government entities provide online access to tax forms, allowing you to download and print a replacement. If this option isn't available, a written request may be required to obtain a new form.

In the meantime, you can reconstruct the missing information using your own records and documentation. Keeping detailed records of all government payments received during the tax year can be invaluable in situations like this. By taking proactive steps, you can ensure your tax filing remains on track even if your 1099-G BO 2 is temporarily unavailable.

How Can You Incorporate the 1099-G BO 2 Into Your Tax Strategy?

Integrating the 1099-G BO 2 into your overall tax strategy involves careful planning and organization. Start by gathering all relevant documents, including your W-2s, 1099s, and any other income statements. Once you have all the necessary information, review the details on the 1099-G BO 2 to ensure they align with your financial records. This step is crucial for maintaining accuracy and consistency in your tax filings.

Consider consulting with a tax advisor to explore potential deductions or credits that may apply to your situation. By leveraging the information from the 1099-G BO 2, you can optimize your tax return and potentially reduce your taxable income. Developing a comprehensive tax strategy that incorporates all relevant forms and documents can lead to a more favorable tax outcome.

What Are the Consequences of Ignoring the 1099-G BO 2?

Ignoring the 1099-G BO 2 can lead to serious consequences, including penalties and interest charges from the IRS. Failing to report the income listed on this form can result in underpayment of taxes, triggering audits or legal action. It's important to address any questions or concerns about the 1099-G BO 2 promptly to avoid these potential pitfalls.

By understanding the implications of the 1099-G BO 2 and taking appropriate action, you can protect yourself from unnecessary financial burdens. Staying informed and proactive in your tax filings ensures compliance with IRS regulations and helps safeguard your financial well-being. Don't underestimate the importance of this form in your overall tax strategy.

Conclusion: Mastering the 1099-G BO 2 for a Stress-Free Tax Season

In conclusion, mastering the intricacies of the 1099-G BO 2 is essential for a stress-free and compliant tax filing experience. By understanding its purpose, components, and implications, you can navigate the complexities of tax season with confidence. Remember to review the information carefully, address any discrepancies promptly, and integrate this form into your overall tax strategy.

With the right approach and resources, you can ensure accurate reporting and optimize your tax return. Whether you're handling your taxes independently or working with a professional, the 1099-G BO 2 plays a critical role in your financial responsibilities. Embrace the knowledge and tools available to make this tax season as smooth and successful as possible.

Table of Contents

- What Exactly is the 1099-G BO 2?

- Why Should You Care About the 1099-G BO 2?

- How Does the 1099-G BO 2 Impact Your Tax Return?

- What Types of Payments Are Reported on the 1099-G BO 2?

- When Should You Expect to Receive the 1099-G BO 2?

- How Can You Verify the Accuracy of the 1099-G BO 2?

- What Steps Should You Take if You Lose Your 1099-G BO 2?

- How Can You Incorporate the 1099-G BO 2 Into Your Tax Strategy?

- What Are the Consequences of Ignoring the 1099-G BO 2?

- Conclusion: Mastering the 1099-G BO 2 for a Stress-Free Tax Season