NY State income tax plays a crucial role in shaping the financial landscape for residents across the state. Whether you're a new resident or a long-time taxpayer, it's essential to stay informed about the latest regulations, exemptions, and strategies to optimize your tax filings. This guide dives deep into the nuances of New York's income tax system, offering valuable insights for individuals and businesses alike. From understanding tax brackets to exploring deductions and credits, this article aims to provide clarity and actionable advice to help you navigate the complexities of NY State income tax efficiently.

Taxes are often considered one of the most challenging aspects of financial management. In New York, the state income tax system adds another layer of complexity to an already intricate federal tax structure. With varying rates, numerous deductions, and specific requirements, staying updated on the latest changes is vital. This article will break down the essential components of the NY State income tax, ensuring you're equipped with the knowledge needed to make informed decisions.

As we delve deeper into the subject, you'll discover how the NY State income tax system operates and how it impacts your overall financial health. Whether you're preparing your annual tax returns or planning for long-term financial goals, understanding the intricacies of state income tax is crucial. This guide will equip you with the tools and information necessary to navigate the tax landscape effectively, helping you avoid common pitfalls and maximize your savings.

Read also:Shiloh Joliepitt A Closer Look At Her Life Family And Influence

What Are the Key Features of NY State Income Tax?

The NY State income tax system is designed to generate revenue for the state while ensuring fairness across different income levels. Key features include progressive tax brackets, which means higher earners pay a larger percentage of their income in taxes compared to lower-income individuals. Additionally, the state offers various deductions and credits to help taxpayers reduce their taxable income. Understanding these features is essential for optimizing your tax strategy and minimizing your liability.

How Does NY State Income Tax Affect Residents?

Residents of New York are subject to both federal and state income taxes. The NY State income tax system is structured to complement federal regulations, ensuring a seamless filing process. However, the state also has its unique rules and requirements that taxpayers must adhere to. For instance, certain deductions allowed at the federal level may not be applicable at the state level, and vice versa. This section will explore how the NY State income tax affects residents and what steps you can take to ensure compliance.

Can You Deduct NY State Income Tax on Your Federal Return?

One common question among taxpayers is whether they can deduct NY State income tax on their federal return. The answer depends on various factors, including your overall tax situation and the specific deductions you choose to claim. Generally, taxpayers have the option to deduct either state and local income taxes or sales taxes on their federal return, but not both. This section will provide a detailed explanation of the rules surrounding this deduction and help you determine the best approach for your situation.

What Are the Tax Brackets for NY State Income Tax?

Tax brackets are a fundamental aspect of the NY State income tax system. They determine how much tax you owe based on your income level. As of the latest updates, New York has several tax brackets, each with its corresponding tax rate. For example, individuals earning up to a certain threshold may pay a lower rate, while those in higher brackets face increased rates. Understanding these brackets is crucial for estimating your tax liability and planning your finances accordingly.

How Do Deductions Impact NY State Income Tax?

Deductions play a significant role in reducing your taxable income, thereby lowering your overall tax liability. NY State offers a variety of deductions, including those for mortgage interest, charitable contributions, and certain business expenses. By taking advantage of these deductions, taxpayers can significantly reduce the amount of income subject to taxation. This section will outline the most common deductions available under the NY State income tax system and provide guidance on how to claim them effectively.

Are There Any Specific Credits Available Under NY State Income Tax?

In addition to deductions, NY State offers several tax credits designed to benefit specific groups of taxpayers. These credits can directly reduce the amount of tax owed, providing valuable savings. Examples include the Earned Income Tax Credit (EITC) for low- to moderate-income individuals and families, as well as credits for education expenses and childcare costs. This section will explore the various credits available and explain how you can qualify for them.

Read also:Megan Fox Nipples A Comprehensive Exploration

How Can You Optimize Your NY State Income Tax Filing?

Optimizing your NY State income tax filing involves more than just completing the necessary forms. It requires careful planning and strategic decision-making to ensure you maximize your deductions and credits while minimizing your tax liability. One effective strategy is to keep detailed records of all income and expenses throughout the year, making it easier to prepare your return accurately. Additionally, consulting with a tax professional or using reputable tax software can help you identify potential opportunities for savings.

What Should You Know About NY State Income Tax Deadlines?

Meeting tax deadlines is critical to avoiding penalties and interest charges. The NY State income tax deadline typically aligns with the federal deadline, usually falling on April 15th each year. However, it's important to note that extensions may be available under certain circumstances. This section will provide an overview of the key deadlines associated with NY State income tax and explain how to request an extension if necessary.

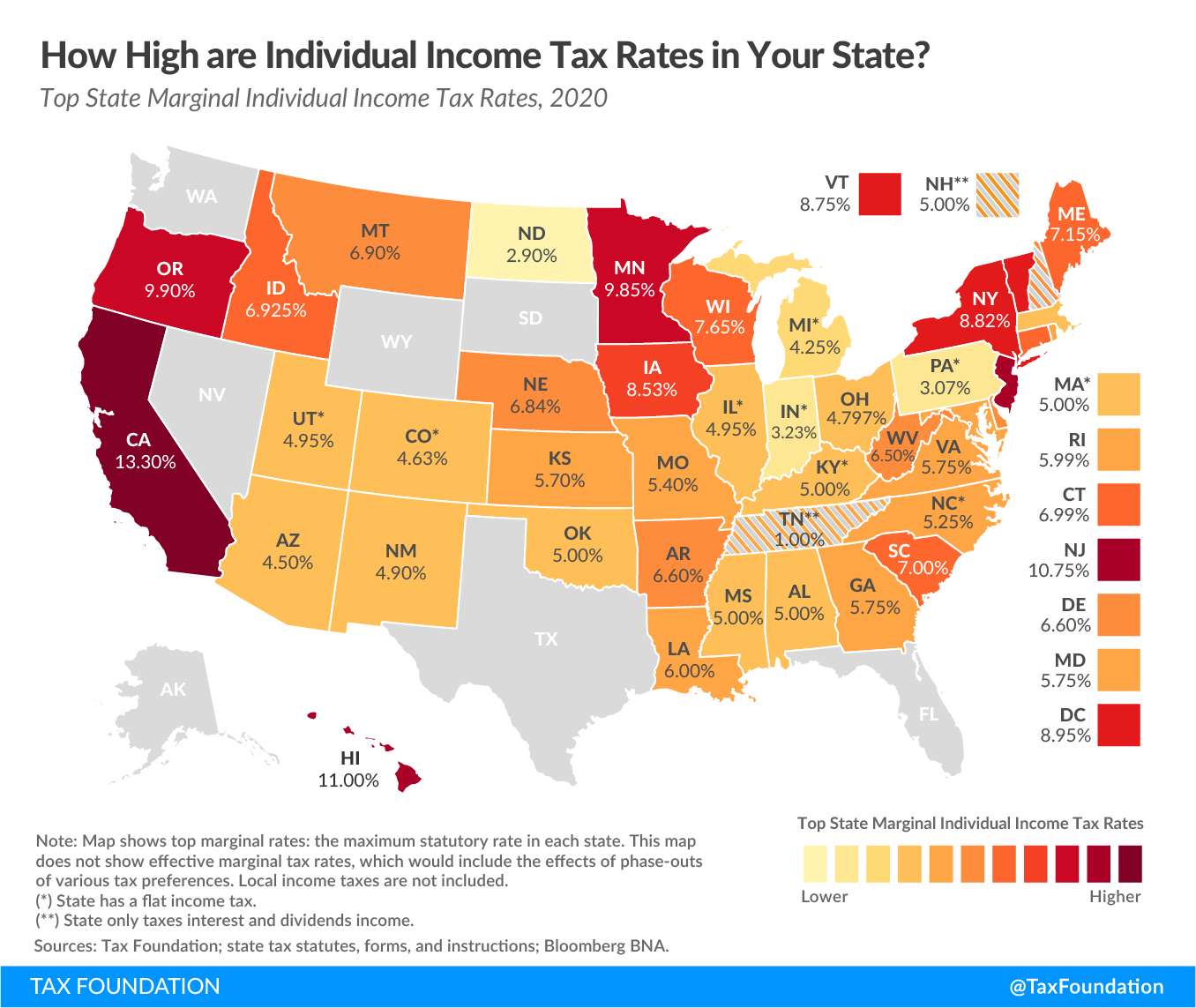

How Does NY State Income Tax Compare to Other States?

When comparing NY State income tax to other states, it's essential to consider factors such as tax rates, available deductions, and overall tax burden. While some states have no income tax or offer flat rates, New York employs a progressive system that adjusts based on income levels. Understanding how NY State income tax compares to other jurisdictions can help you make informed decisions, especially if you're considering relocating or conducting business in another state.

Conclusion

In conclusion, navigating the complexities of NY State income tax requires a thorough understanding of the system's key components and features. From tax brackets and deductions to credits and deadlines, this guide has provided comprehensive insights into the various aspects of the NY State income tax system. By staying informed and utilizing the strategies outlined here, you can effectively manage your tax obligations and optimize your financial well-being.

Table of Contents

- What Are the Key Features of NY State Income Tax?

- How Does NY State Income Tax Affect Residents?

- Can You Deduct NY State Income Tax on Your Federal Return?

- What Are the Tax Brackets for NY State Income Tax?

- How Do Deductions Impact NY State Income Tax?

- Are There Any Specific Credits Available Under NY State Income Tax?

- How Can You Optimize Your NY State Income Tax Filing?

- What Should You Know About NY State Income Tax Deadlines?

- How Does NY State Income Tax Compare to Other States?

- Conclusion

Remember, staying informed about NY State income tax regulations and updates is crucial for effective financial planning. Regularly reviewing your tax strategy and seeking professional advice when needed can help you navigate the complexities of the system and achieve your financial goals.