New York State Income Tax: A Comprehensive Guide To Navigating Your Finances

Apr 18 2025

Understanding the intricacies of New York State income tax is crucial for residents and businesses alike. As one of the most economically vibrant states in the U.S., New York has a complex taxation system that can be challenging to navigate without proper guidance. Whether you're a first-time filer or a seasoned taxpayer, staying informed about the latest regulations and filing procedures is essential. This article delves into the key aspects of New York State income tax, offering valuable insights and practical advice to help you manage your financial obligations effectively.

New York State income tax plays a significant role in funding public services and infrastructure. The state's tax policies are designed to ensure equitable contributions from all income brackets while promoting economic growth. However, navigating the tax code can be daunting, especially with frequent changes in legislation. By understanding the basics of New York State income tax, you can make informed decisions that benefit both your personal finances and the broader community.

This comprehensive guide aims to simplify the complexities of New York State income tax. From explaining the filing process to highlighting deductions and credits, we provide actionable tips to help you optimize your tax strategy. Whether you're a resident, business owner, or simply curious about the tax landscape in New York, this article offers valuable insights tailored to your needs.

Read also:Hdhub4u 18 Your Ultimate Guide To Premium Content And Beyond

What Are the Key Features of New York State Income Tax?

New York State income tax is characterized by its progressive tax rates, which vary depending on your income level. As of the latest updates, the state imposes tax brackets ranging from 4% to 10.9% for high-income earners. These rates are subject to change, so it's essential to stay updated with the latest regulations. Additionally, the state offers various deductions and credits to help taxpayers reduce their taxable income. Understanding these features can significantly impact your tax liability and overall financial planning.

How Does New York State Income Tax Differ from Federal Taxes?

While federal taxes are governed by the IRS, New York State income tax operates under its own set of rules and regulations. One key difference is the availability of state-specific deductions and credits, such as the New York State Earned Income Tax Credit (EITC). Additionally, New York residents must file both federal and state tax returns, ensuring compliance with both jurisdictions. This dual obligation underscores the importance of accurate record-keeping and timely submissions.

Can You Claim Deductions on New York State Income Tax?

Absolutely. New York State offers a range of deductions to help taxpayers lower their taxable income. These include standard deductions, itemized deductions, and specific exemptions for dependents. For instance, the state allows deductions for contributions to retirement plans, mortgage interest, and certain medical expenses. By leveraging these deductions strategically, you can minimize your tax burden and maximize your savings.

Who Needs to File New York State Income Tax?

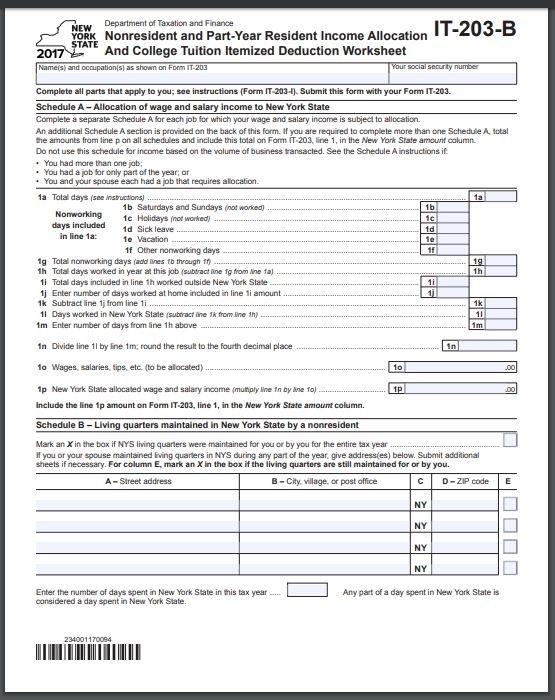

Filing New York State income tax is mandatory for all residents who earn above a certain threshold. This includes full-time residents, part-year residents, and nonresidents with income sourced from the state. The filing requirements vary based on factors such as income level, marital status, and filing status. Ensuring timely and accurate filings is crucial to avoid penalties and interest charges.

What Are the Deadlines for Filing New York State Income Tax?

The deadline for filing New York State income tax typically aligns with the federal tax deadline, which is April 15th of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who require additional time can request an extension, but it's important to note that this only extends the filing deadline, not the payment deadline. Planning ahead and organizing your financial records can help you meet these deadlines effortlessly.

Is It Necessary to Hire a Tax Professional for New York State Income Tax?

While it's possible to file New York State income tax independently, hiring a tax professional can be beneficial, especially for complex cases. Tax professionals possess in-depth knowledge of the state's tax code and can help you identify potential deductions and credits. They also ensure compliance with all regulations, reducing the risk of errors or penalties. However, if your tax situation is straightforward, utilizing tax software or online resources may suffice.

Read also:Zodiacs As Gods Unveiling Celestial Legends Beyond The Stars

Understanding the New York State Income Tax Filing Process

The process of filing New York State income tax involves several steps, starting with gathering all necessary documents. These include W-2 forms, 1099 forms, and any other relevant financial records. Once you have all the required information, you can proceed to complete Form IT-201, the New York State resident income tax return. Filing electronically through the state's official website or authorized third-party platforms is highly recommended for faster processing and reduced errors.

What Are the Common Mistakes to Avoid When Filing New York State Income Tax?

Common mistakes when filing New York State income tax include incorrect Social Security numbers, miscalculations, and missing deductions. To avoid these errors, double-check all entries and cross-reference your records with supporting documents. Additionally, ensure that you select the correct filing status and claim all eligible deductions and credits. Utilizing tax preparation software or consulting with a tax professional can further reduce the likelihood of mistakes.

How Can You Maximize Your Refund on New York State Income Tax?

To maximize your refund on New York State income tax, it's essential to take advantage of all available deductions and credits. This includes claiming the New York State Child Tax Credit, the School Tax Relief (STAR) credit, and any other applicable incentives. Keeping detailed records of your expenses and contributions throughout the year can help you identify additional opportunities for savings. Additionally, reviewing your withholding allowances can ensure that you're not overpaying your taxes.

Exploring the Impact of New York State Income Tax on Residents

New York State income tax has a profound impact on residents, influencing everything from disposable income to investment decisions. By understanding how the tax system works, individuals and businesses can make informed choices that align with their financial goals. For instance, knowing the tax implications of relocating to New York or starting a business in the state can help you plan effectively. Staying informed about tax reforms and legislative changes is equally important to adapt to evolving circumstances.

What Are the Latest Developments in New York State Income Tax?

Recent developments in New York State income tax include updates to tax brackets, deductions, and credits. The state has introduced new initiatives to support low- and middle-income families, such as expanded eligibility for the Earned Income Tax Credit. Additionally, efforts to combat tax evasion and ensure compliance have intensified, with increased scrutiny of high-income filers. Keeping abreast of these developments can help you navigate the tax landscape more effectively.

Table of Contents

- Key Features of New York State Income Tax

- Differences Between State and Federal Taxes

- Claiming Deductions on New York State Income Tax

- Filing Requirements

- Deadlines for New York State Income Tax

- Hiring a Tax Professional

- Filing Process

- Avoiding Common Mistakes

- Maximizing Your Refund

- Impact of New York State Income Tax

In conclusion, mastering the intricacies of New York State income tax is vital for ensuring financial stability and compliance. By staying informed about the latest regulations and leveraging available deductions and credits, you can optimize your tax strategy and achieve greater financial freedom. Whether you're a resident, business owner, or simply seeking knowledge, this guide provides the tools and insights needed to navigate the complexities of New York State income tax successfully.

Remember, the key to effective tax planning lies in preparation and awareness. Stay updated with the latest developments, utilize available resources, and seek professional guidance when needed. With a proactive approach, you can turn the complexities of New York State income tax into opportunities for growth and savings.