NYS TA tables play a pivotal role in understanding the intricacies of New York State tax regulations. As a cornerstone for tax professionals and individuals alike, these tables offer critical insights into the calculation of taxes, deductions, and credits. Whether you're a seasoned accountant or someone navigating the complexities of state taxes for the first time, understanding NYS TA tables is essential to ensuring compliance and optimizing your financial health.

These tables are not just numbers but a detailed framework that dictates how much tax individuals and businesses owe to the state. The complexity of the tax code means that a misinterpretation of these tables can lead to costly errors. Hence, having a solid grasp of NYS TA tables is crucial. In this article, we will delve into the nuances of these tables, explore their practical applications, and provide actionable insights to help you navigate the tax landscape effectively.

With the ever-changing tax laws and regulations, staying informed is more important than ever. This guide aims to equip you with the knowledge and tools necessary to make sense of NYS TA tables and empower you to take control of your tax responsibilities. By the end of this article, you will have a clearer understanding of how these tables work and how they impact your financial planning.

Read also:Dti Uniforms A Comprehensive Guide To Stylish And Functional Workwear

What Are NYS TA Tables?

NYS TA tables are official documents issued by the New York State Department of Taxation and Finance. These tables serve as a reference for calculating various taxes, including income tax, sales tax, and property tax. They are updated regularly to reflect changes in legislation, ensuring that taxpayers have access to the most current information.

For instance, the tables provide detailed brackets for income tax calculations, helping individuals determine their tax liability based on their earnings. Similarly, businesses rely on these tables to calculate sales tax accurately, avoiding penalties and ensuring compliance with state regulations.

Why Should You Care About NYS TA Tables?

Understanding NYS TA tables is crucial for anyone who pays taxes in New York State. Whether you're an individual taxpayer or a business owner, these tables directly impact your financial obligations. Ignoring them can lead to underpayment or overpayment of taxes, both of which come with their own set of consequences.

Moreover, familiarity with NYS TA tables can help you identify potential deductions and credits that you might be eligible for. This knowledge can translate into significant savings, allowing you to allocate your resources more effectively.

How Do NYS TA Tables Impact Your Taxes?

The impact of NYS TA tables on your taxes cannot be overstated. These tables determine the exact amount of tax you owe based on your income, deductions, and credits. For example, if you fall into a higher income bracket, the tables will reflect a higher tax rate, affecting your overall tax liability.

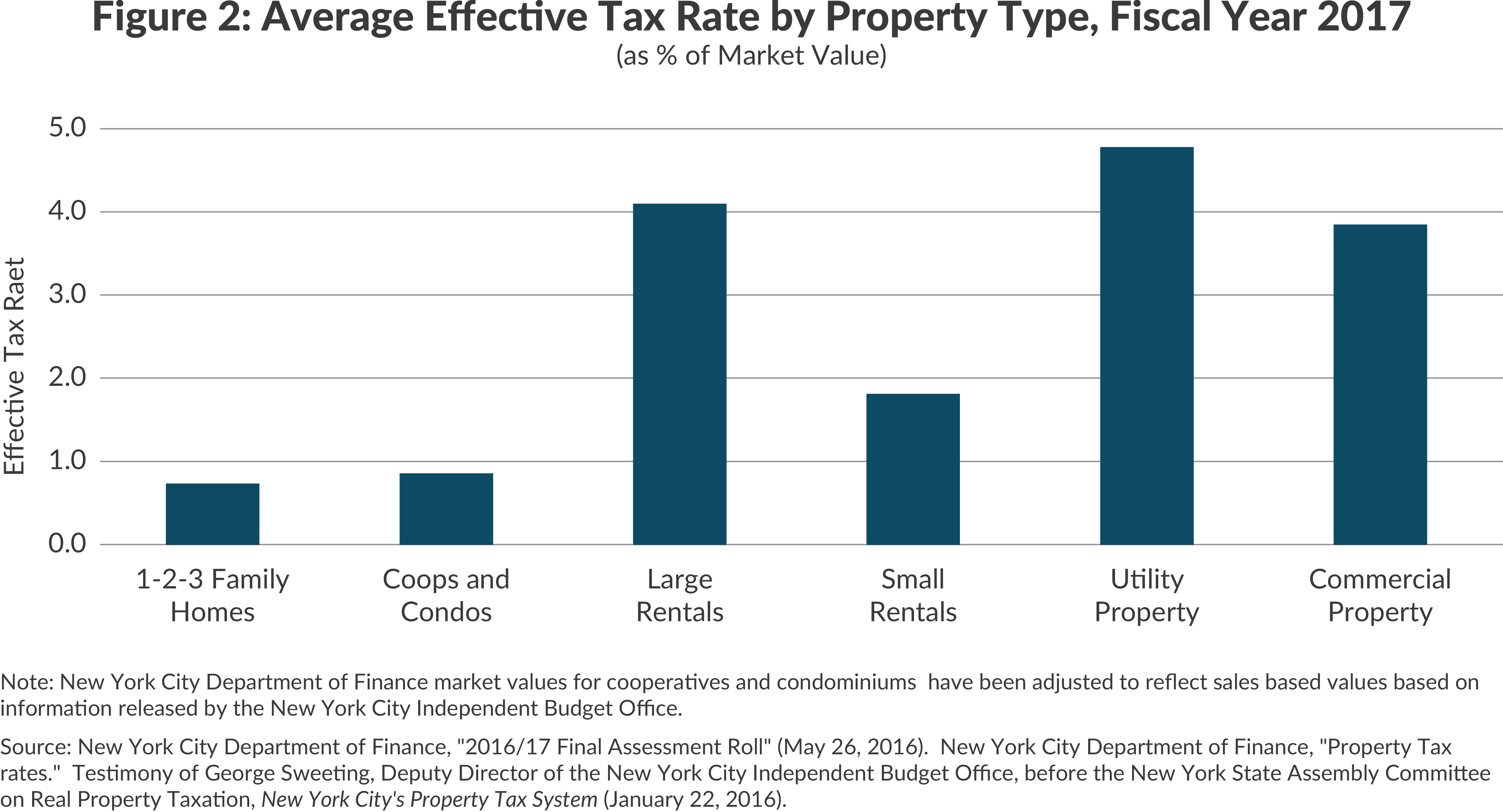

Additionally, NYS TA tables are instrumental in calculating property taxes. Homeowners can use these tables to estimate their annual property tax payments, helping them budget accordingly. This level of detail ensures that taxpayers are well-informed and prepared for their financial responsibilities.

Read also:Kim Kardashian And Diddy Exploring Their Connection And Influence In Pop Culture

How Are NYS TA Tables Structured?

The structure of NYS TA tables is designed to be both comprehensive and user-friendly. Each table is organized into clear sections, making it easier for users to locate the information they need. For instance, the income tax tables are divided into brackets, with corresponding tax rates for each bracket.

Similarly, sales tax tables provide detailed rates for different counties and municipalities within New York State. This ensures that businesses can accurately calculate sales tax regardless of their location. The clarity and organization of these tables make them an indispensable tool for anyone dealing with New York State taxes.

Can NYS TA Tables Be Used for Business Tax Planning?

Absolutely! NYS TA tables are invaluable for businesses looking to plan their taxes effectively. By referencing these tables, businesses can estimate their tax liabilities and make informed decisions about their financial strategies. For example, a company can use the sales tax tables to ensure that it is charging the correct rate to its customers, avoiding potential disputes with tax authorities.

Furthermore, businesses can utilize the income tax tables to assess their profitability and adjust their operations accordingly. This proactive approach to tax planning can lead to significant cost savings and improved financial performance.

What Are the Key Features of NYS TA Tables?

One of the key features of NYS TA tables is their ability to provide precise calculations for various tax scenarios. Whether you're dealing with income tax, sales tax, or property tax, these tables offer the necessary data to ensure accuracy. Additionally, the tables are regularly updated to reflect changes in tax laws, ensuring that users always have access to the most current information.

Another important feature is the inclusion of detailed notes and explanations, which help users interpret the data correctly. This level of detail is particularly useful for those who may not have a strong background in tax matters but still need to navigate the complexities of NYS TA tables.

Where Can You Find the Latest NYS TA Tables?

The latest NYS TA tables can be found on the official website of the New York State Department of Taxation and Finance. This ensures that you are accessing the most up-to-date and accurate information. Additionally, many tax professionals and financial advisors keep copies of these tables on hand to assist their clients with tax-related matters.

It's important to note that while online resources can be convenient, they may not always be the most reliable. To ensure accuracy, always verify the information against the official NYS TA tables provided by the Department of Taxation and Finance.

Who Benefits Most from NYS TA Tables?

While NYS TA tables are beneficial to everyone who pays taxes in New York State, certain groups stand to gain more than others. Tax professionals, for instance, rely heavily on these tables to provide accurate advice and services to their clients. Similarly, businesses benefit greatly from the clarity and precision offered by these tables, enabling them to operate more efficiently and cost-effectively.

Individual taxpayers also benefit from NYS TA tables, as they provide a straightforward way to calculate tax liabilities and identify potential deductions and credits. This empowers individuals to take control of their financial futures and make informed decisions about their tax obligations.

Is It Difficult to Understand NYS TA Tables?

While NYS TA tables may seem daunting at first glance, they are designed to be accessible to a wide range of users. With some basic knowledge of tax principles and a willingness to learn, most people can understand and utilize these tables effectively. Additionally, there are numerous resources available, including tutorials and guides, to help users navigate the complexities of NYS TA tables.

For those who find the tables challenging, consulting with a tax professional can provide clarity and ensure that all calculations are accurate. This extra step can save time and prevent costly mistakes down the line.

How Can You Use NYS TA Tables for Personal Finance?

Using NYS TA tables for personal finance involves understanding how these tables impact your individual tax situation. By referencing the income tax tables, you can estimate your tax liability and plan your finances accordingly. This proactive approach can help you avoid surprises at tax time and ensure that you are meeting all your obligations.

Additionally, the property tax tables can be used to estimate your annual property tax payments, allowing you to budget for these expenses. This level of preparation can help you maintain financial stability and avoid unexpected financial burdens.

What Should You Look for in NYS TA Tables?

When using NYS TA tables, it's important to focus on the sections that are most relevant to your situation. For example, if you're calculating income tax, pay attention to the brackets and corresponding tax rates. Similarly, if you're dealing with sales tax, ensure that you are using the correct rate for your location.

Another key aspect to look for is any notes or footnotes that accompany the tables. These often contain important information that can affect your calculations, such as changes in legislation or special considerations for certain groups of taxpayers.

How Often Are NYS TA Tables Updated?

NYS TA tables are updated regularly to reflect changes in tax laws and regulations. These updates ensure that taxpayers have access to the most current information, helping them stay compliant and avoid penalties. It's important to check for updates periodically, especially if there have been recent changes to the tax code.

Staying informed about updates to NYS TA tables can also help you take advantage of new deductions and credits that you may be eligible for. This proactive approach can lead to significant savings and improved financial outcomes.

Conclusion: Why NYS TA Tables Are Essential

In conclusion, NYS TA tables are an essential tool for anyone dealing with New York State taxes. They provide the necessary data to calculate tax liabilities accurately, identify potential deductions and credits, and ensure compliance with state regulations. Whether you're a tax professional, business owner, or individual taxpayer, understanding these tables is crucial to your financial well-being.

By familiarizing yourself with NYS TA tables, you can take control of your tax responsibilities and make informed decisions about your financial future. With the right knowledge and tools, navigating the complexities of New York State taxes becomes a manageable task, empowering you to achieve financial success.

Table of Contents

- What Are NYS TA Tables?

- Why Should You Care About NYS TA Tables?

- How Do NYS TA Tables Impact Your Taxes?

- How Are NYS TA Tables Structured?

- Can NYS TA Tables Be Used for Business Tax Planning?

- What Are the Key Features of NYS TA Tables?

- Where Can You Find the Latest NYS TA Tables?

- Who Benefits Most from NYS TA Tables?

- Is It Difficult to Understand NYS TA Tables?

- How Can You Use NYS TA Tables for Personal Finance?